Depreciation value is calculated by the formula

Periodic Depreciation Expense Beginning book value x Rate of depreciation. The straight line calculation steps are.

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

It is determined by multiplying the book value of the asset by the straight-line methods rate of depreciation and 2 read more method to calculate the tanks depreciation expense.

. Amount of Annual Depreciation. Depreciation is calculated on the original cost of fixed assets. The asset experiences a total depreciation value of 938 each month of its useful lifespan.

The formula for calculating straight-line depreciation is as follows. Book value Cost of the asset accumulated depreciation. How to Calculate Straight Line Depreciation.

Netbook value is calculated by subtracting Accumulated Depreciation from the cost of the asset. Depreciation formula for the double-declining balance method. The first two arguments are the same as they were in Section 1 with the other arguments.

25000 - 50050000 x 5000 2450. It is determined by multiplying the book value of the asset by the straight-line methods rate of depreciation and 2 read more method to calculate the tanks depreciation. Depreciation 2 Straight line depreciation percent book value at the beginning of the accounting period.

Non-ACRS Rules Introduces Basic Concepts of Depreciation. It is the initial book value. Subtract the estimated salvage value of the asset from.

Depreciation Amount for year one 10000 1000 x 20. Purchase or acquisition price of the asset - estimated salvage value of asset useful life of asset straight. This is the cost of the fixed asset.

Depreciation Percentage - The depreciation percentage in year 1. 228052-16071307 x 100. By charting the decrease in the value of an asset or assets depreciation reduces the amount of taxes a company or business pays via tax deductions.

Depreciation is calculated on the book value of fixed assets. Determine the cost of the asset. To figure out what inflation means for the worth of 5 first you need to.

The closing value for year one is calculated by subtracting the. It is calculated by simply. The basic way to calculate depreciation is to take the.

Calculating Depreciation Using the Units of Production Method. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. The formula is cost salvage useful life in units units produced in period.

Asset cost - salvage valueestimated units over assets life x actual units made. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. The amount of annual.

Depreciation is a method for spreading out deductions for a long-term business asset over several years. Depreciation on Income Statement. Cost of AssetDepreciation PercentageYear 2.

Depreciation Amount for year one 1800. If the salvage value of an asset is known the cost of the asset can. For instance a widget-making machine is said to depreciate.

A company buys a computer for 2000 that has a useful lifespan of five years and its estimated salvage value after five years is 500. So the total sum of future inflation is 65235 between 1990 and 2010. In regards to depreciation salvage value is the estimated worth of an asset at the end of its useful life.

Here is the step by step approach for calculating Depreciation expense in the first method.

Depreciation Bookkeeping Business Accounting Education Accounting Basics

Business Valuation Veristrat Infographic Business Valuation Business Infographic

The Sum Of The Years Digits Method Of Depreciation Accounting Education Learn Accounting Sum

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Fair Value Meaning Approaches Levels And More Learn Accounting Bookkeeping And Accounting Accounting Education

Trade Brains Simplified Stock Investing For Everyone Learn To Invest Financial Ratio Finance Investing Investing In Stocks

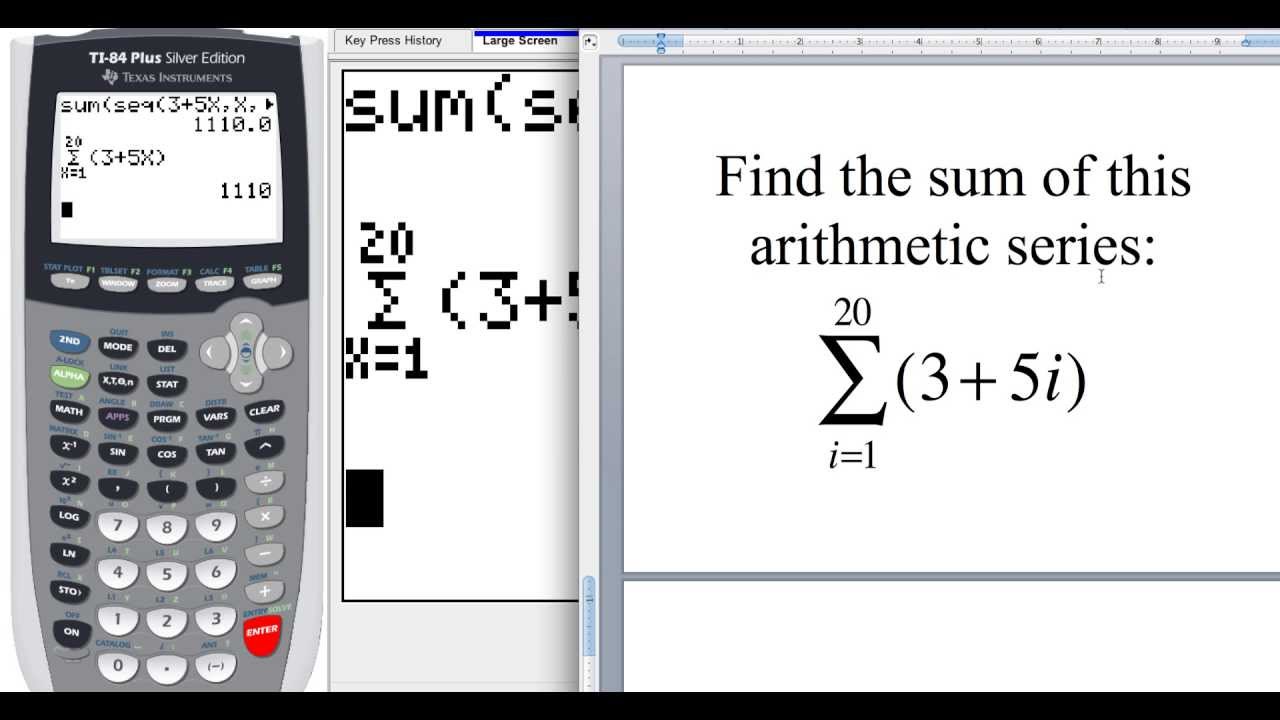

12 2 How To Find The Sum Of An Arithmetic Sequence On The Ti 84 Graphing Calculators Arithmetic Math Tools

The Simplest And Most Commonly Used Method Straight Line Depreciation Is Calculated By Taking The Purchase Or Acquisitio Business Valuation Method Subtraction

Ev To Ebitda Meaning Formula Interpretation And More Enterprise Value Money Management Advice Learn Accounting

Methods Of Depreciation Learn Accounting Method Accounting And Finance

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

Net National Product And Net Domestic Income Agency Law Flow Chart Business Management

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

The Book Value Per Share Formula Is Used To Calculate The Per Share Value Of A Company Based On Its Equity Available To Co Book Value Business Valuation Shared

Calculate Depreciation In Excel With Sln Straight Line Method By Learnin Learning Centers Excel Tutorials Excel